WeChat for Dummies: Cross-border online payment

An introduction to the basics of WeChat pay for cross-border transaction. What is the mechanism of WeChat Cross-border Payment? How to set up your account? What is the transaction limit?

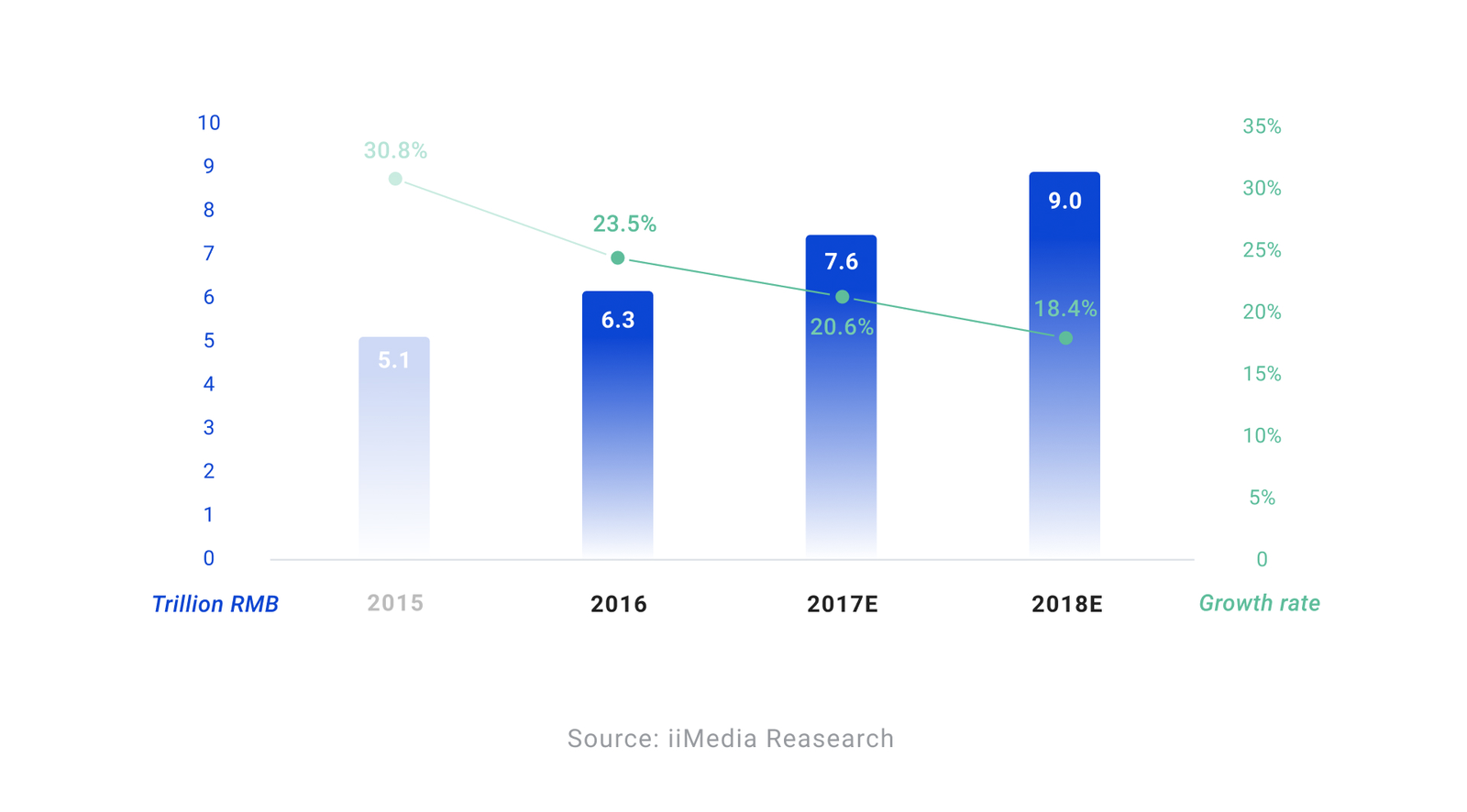

According to iiMedia’s recent report, Chinese cross-border e-commerce transactions reached 6.7 trillion RMB in 2016, and increased significantly to 7.6 trillion RMB($1.22 trillion) in 2017. For 2018, the overall transaction scale is expected to reach 9 trillion RMB($1.55 trillion).

Meanwhile, as part of the construction of “One Belt, One Road “, the Chinese government has been providing policy and investment support to further facilitate cross-border e-commerce and foreign trade. As announced by the Central Bank in January, China will encourage companies to increase their use of Yuan for settling cross-border trade deals and to support foreigners’ use of the currency for direct investment in the country.

Alipay and WeChat Pay are the most popular payment methods for cross-border commerce transaction for Chinese. In this article, we’ll be discussing the most commonly asked questions of WeChat Pay for cross-border payment.

What is WeChat Pay?

WeChat Pay is a payment feature integrated into the WeChat app that allows users to complete transactions directly through their smartphones. Optimized for the WeChat ecosystem, WeChat Pay provides a seamless user experience for both O2O business scenarios and cross-border commerce.

What is WeChat Cross-border Payment?

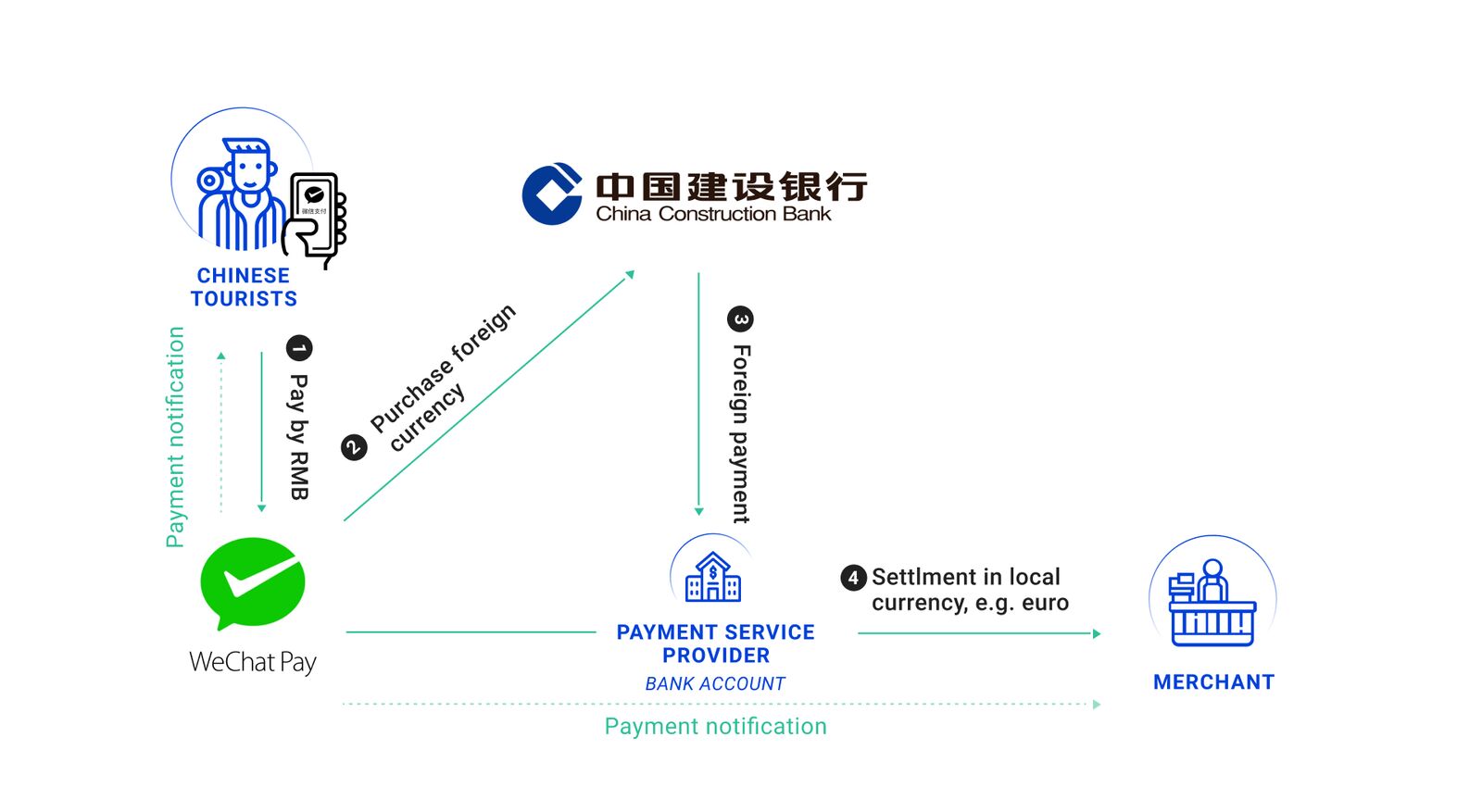

WeChat Pay cross-border service allows customers to use Chinese currency to pay for goods or services sold by overseas merchants (both online and offline). WeChat Pay will then remit the amount in the foreign currency to the receiving bank account of the merchant in settlement.

WeChat Pay has been available to overseas vendors since early 2016. If you are a foreign brand looking at entering the China market or targeting Chinese customers overseas, WeChat Pay is definitely a payment gateway you want to focus on.

Why WeChat Pay for Cross-border Commerce?

- Chinese customers can easily adapt their domestic lifestyle overseas.

- The phone-scannable QR code lowers the setup barrier for merchants- no need for hardware like a card or chip readers.

- The merchant gets involved in each step of the customer lifecycle. From brand awareness through WeChat social sharing, user segmentation, to customer service through invoicing and personalized service etc. Upon the completion of a transaction, users have the option of following the brand’s official WeChat account or submitting a post-purchase survey.

- Leverage the potential of over 1 billion WeChat users.

- Safety and security: WeChat Pay provides full transaction insurance 24/7. It also includes security features like data encryption, website phishing protection, and payment limits. User activity is also constantly monitored for anything suspicious and multi-step verification processes are in place to ensure users are able to make payments securely.

Shopping Scenario Examples

WeChat Pay is flexible enough to support various shopping scenarios for both online and offline.

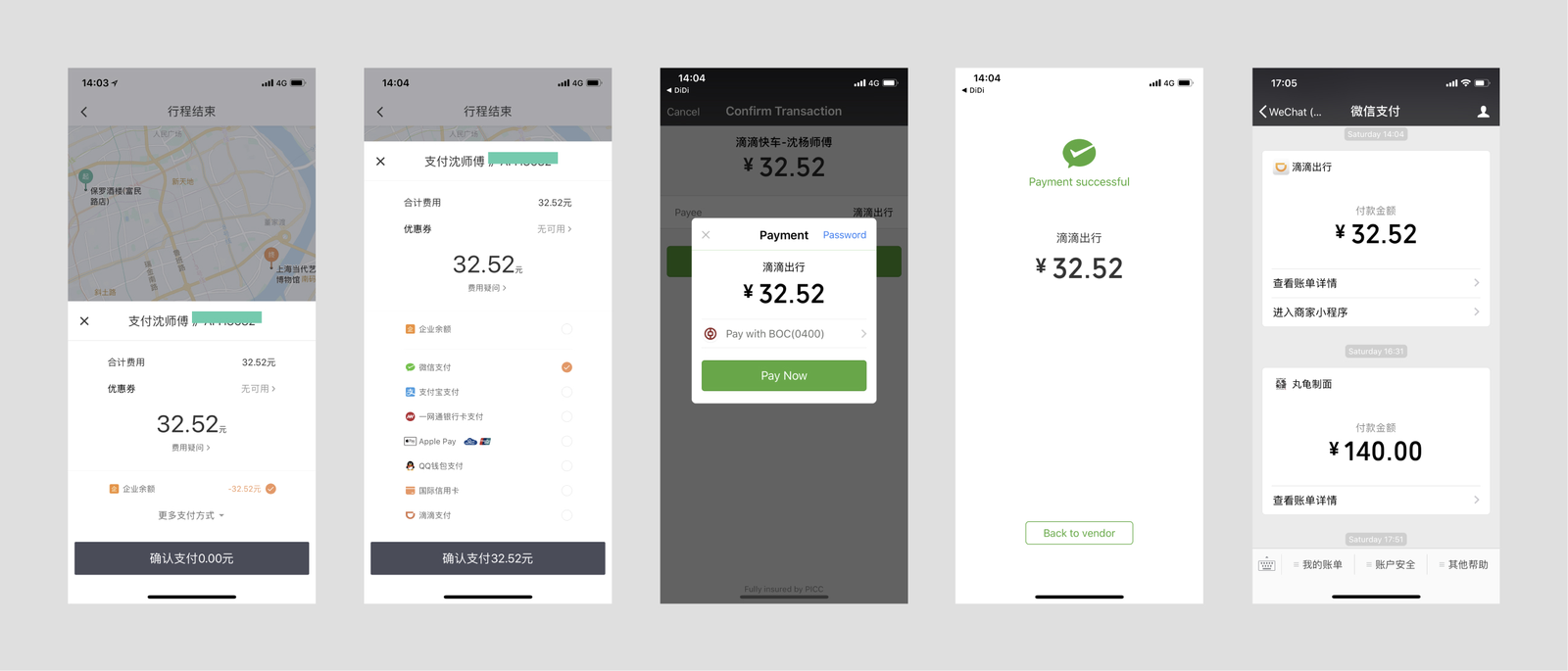

1) In-app payment: integrate WeChat Pay on your app as a payment option

2) In-app web-based payment: user opens the merchant’s H5 commerce site through WeChat and calls the WeChat payment module to proceed with the transaction.

Common scenarios include:

- official account payment

- user opens the payment URL in a chat or in moments

- user scans the payment QR code displayed on merchant’s page and opens it in a browser to complete the payment

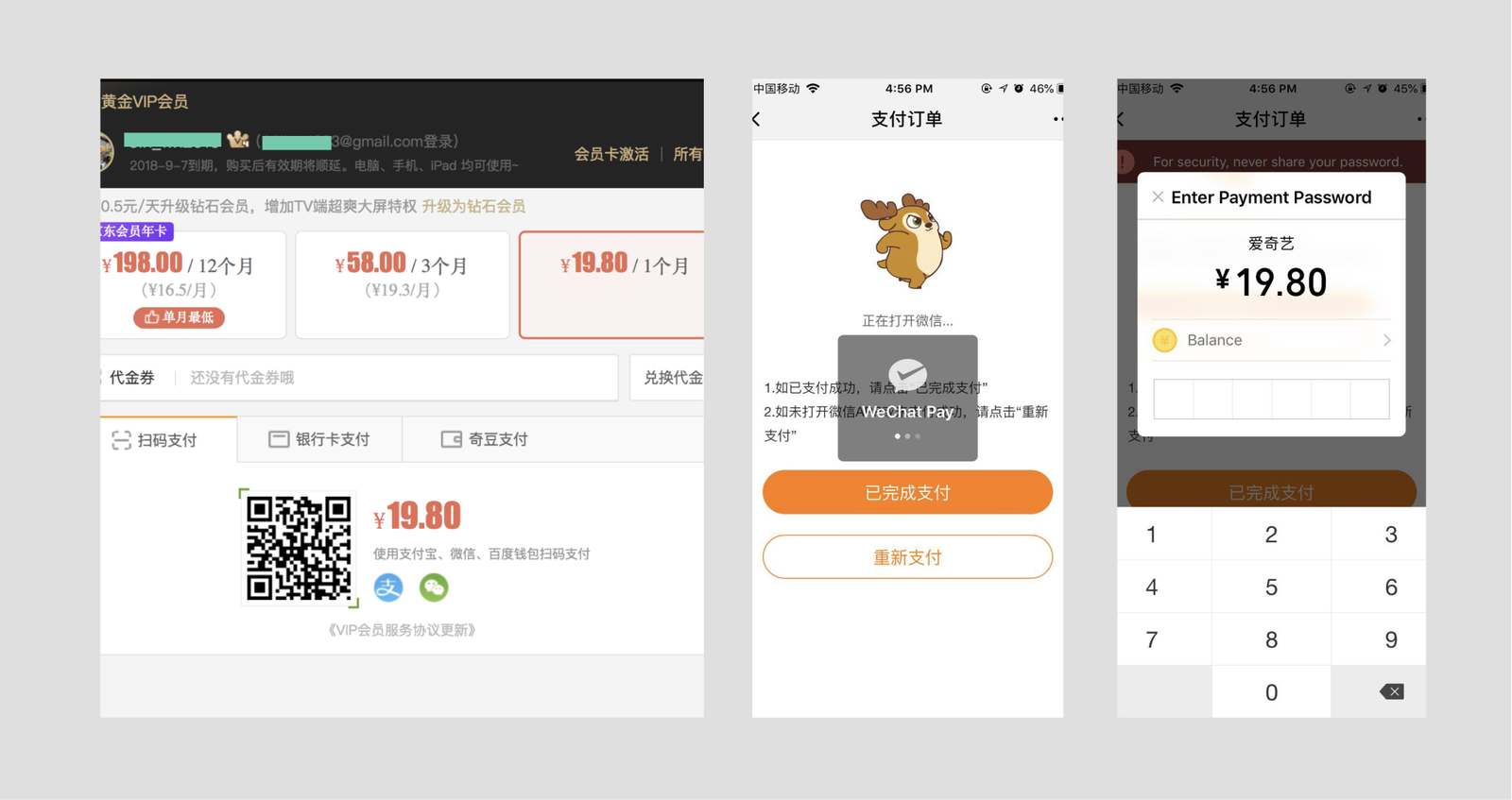

3) QR code pay: user scans the QR code (either on web or offline) to pay

4) Quick Pay (微信买单): merchant scans the QR code shown by users on the quick pay page to complete the transaction. This feature doesn’t need extra development and credit card pay is also supported.

Different roles in WeChat Pay Cross-border service

1) Overseas Merchants WeChat Pay cooperates directly with foreign merchants. Payments are settled directly to the receiving bank account of the merchants. WeChat will sign the service agreement with overseas merchants.

2) System Integrators System integrators integrate WeChat Pay as an alternative payment method to their merchants. Payments are settled directly to the foreign merchants. WeChat Pay will sign the agreement with both the foreign merchant and the system integrator.

3) Payment Companies Overseas Payment Companies integrate WeChat Pay as an alternative payment method for their merchants. The payment is settled to merchants by the foreign payment companies. WeChat will sign the agreement with the payment company but not with the merchant.

How to set up WeChat Pay for Cross-border Transactions?

There are two options to create a cross-border payment account:

Option 1: Set up directly with Tencent (商户直连): The payment will be settled directly from Tencent to your company’s account. As the setup process is mostly handled manually, it can take 2-3 months with a very low approval rate. You can find the step-by-step application guide [here] (https://pay.weixin.qq.com/wechatpay_guide/help_apply.shtml) .

Currently only the following countries and regions support this option: Online transaction: Taiwan, Australia, USA, Russia, Indonesia, Philippines, Macau, Cambodia. Online & Offline transaction: Hong Kong, Singapore, UK, Japan, Korea, Holland, Thailand, Canada.

Option 2: Set up via WeChat Pay Service Provider (机构服务商): This is the most popular way and usually takes 1-2 weeks.

You can search for the service provider info based on your country here.

Note: Institutions with financial licenses can become a Financial Institution Partner and offer WeChat Cross-border Pay to merchants.

Check out the required documents for applying here.

What currencies does Wechat Pay cover?

WeChat Pay currently supports 12 major currencies including but not limited to GBP, HKD, USD, JPY, CAD, AUD, EUR, NZD, KRW, THB, SGD, RUB. WeChat Pay will settle with vendors according to the price in local currency. For unsupported currencies, trade can be made through settlement of US dollars.

Note: If the currency of your country is not on this list, you can open a multi-currency bank account to accept payment.

How is the exchange rate determined?

When the buyer has completed the payment, the amount will be allocated to a partner settlement bank for currency exchange. After collecting payment from the buyers’ account, WeChat Pay will buy foreign currency in T+1 day according to the spot rate that the settlement bank provides. When vendors’ turnover accumulates to 5000 USD (lower limit), WeChat will transfer payment to the receiving bank account of vendors.

What are the limitations on transaction?

From the perspective of customers: the transaction limit is decided by both the payment platform and the bank.

On WeChat, the daily limit for each transaction is 10,000 RMB(1,500 USD), the annual transaction limit of WeChat “Balance” is 200,000 RMB (30,000 USD). If you go over that amount, pay via a bank card; if you go over the expenditure quota of that bank card, verify your ID info to add a new card. You can also contact your bank to raise expenditure quota of the card.

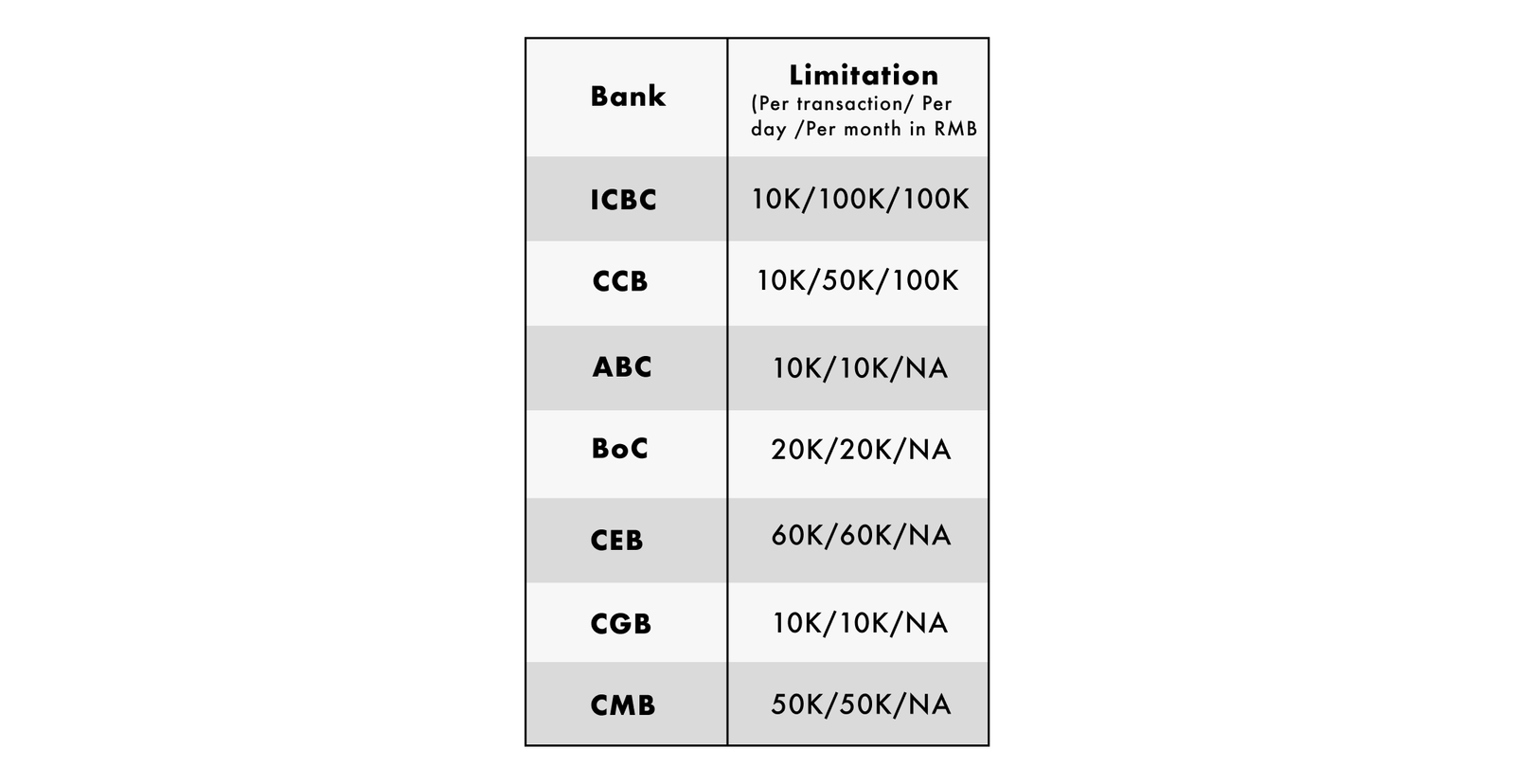

On the bank side, the transition limitation varies both on bank policy and expenditure quota setting.

From the perspective of merchants: currently there’s no limitation on the amount of money they can receive. Once the customer completes a payment, the amount will be allocated to a partner settlement bank for currency exchange. After collecting payment from the customer’ account instantly, WeChat Pay will buy foreign currency in T+1 day according to the spot rate that the settlement bank provides. When vendors’ turnover accumulates to 5000 USD (lower limit), the payment gets transferred to the receiving bank account of vendors immediately.

What’s the transaction period?

The transaction period is typically T+1, T+3, T+5, T+7, based on the local bank’s transaction process.

Reference:

WeChat Pay: https://pay.weixin.qq.com/public/wechatpay

Tenpay: http://global.tenpay.com/

Chinese cross-border consumer report: https://adstochina.westwin.com/cross-border-consumption-report.shtml

Payment methods: https://pay.weixin.qq.com/wechatpay_guide/intro_method.shtml https://jingdaily.com/cross-border-e-commerce/

2018-2022 China Cross-border E-commerce Transaction Forecast, Jumore Global: https://insights.jumoreglobal.com/2018-2022-china-cross-border-e-commerce-transaction-forecast/

China’s cross-border e-commerce retail market forecast 2018-2021, China Internet Watch: https://www.chinainternetwatch.com/24363/cross-border-ecommerce-retail-2021/