New Strategies for New Luxury: How to succeed in the affluent Chinese market

It is not the most renowned brands, nor the most experienced, but the ones most responsive to change that survive over time. Tectonic shifts in the luxury landscape have been enlarging these gaps markedly; it’s time to get into the game.

Tectonic shifts in the luxury landscape: the high-end goods market is growing again after a bumpy 2016

In an industry report published this year, Bain predicts that the global personal luxury goods market is expected to grow by 2-4 percent to a total of €254-259bn (¥1.97-2.01tn) in 2017. Looking ahead to 2020, the market size should reach €280-290bn (¥2.18-2.26tn), with mild growth of 3-4 percent year on year.

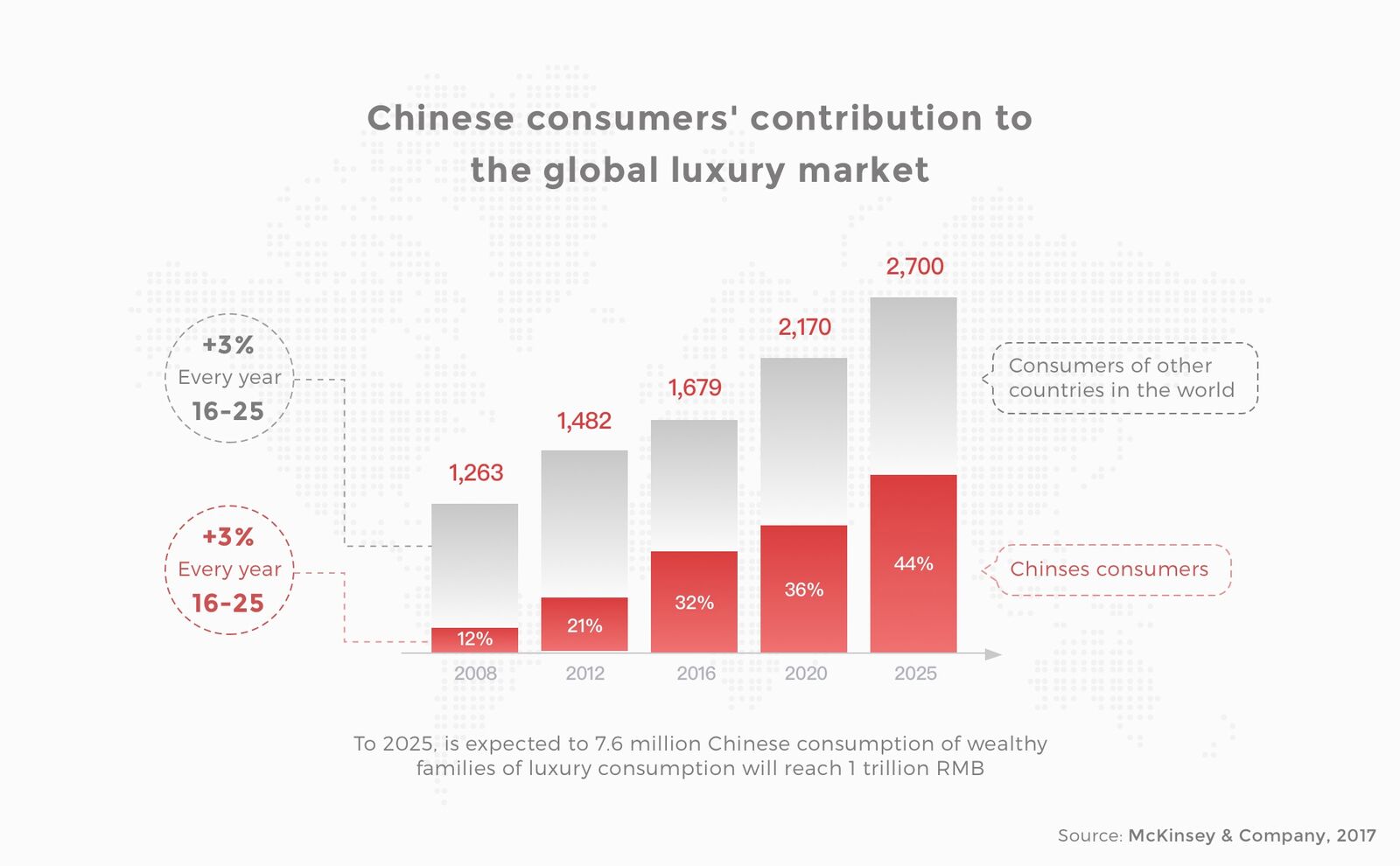

Today, Chinese consumers already account for almost half of global luxury market spending. By 2025, the global luxury market is expected to reach 2.7 trillion RMB and that Chinese consumers will continue to be the major driving force.

As the importance of the Chinese market and Chinese shoppers is well demonstrated across different reports, it’s time to get into the game.

New luxury in China: a call for luxury brands to go digital

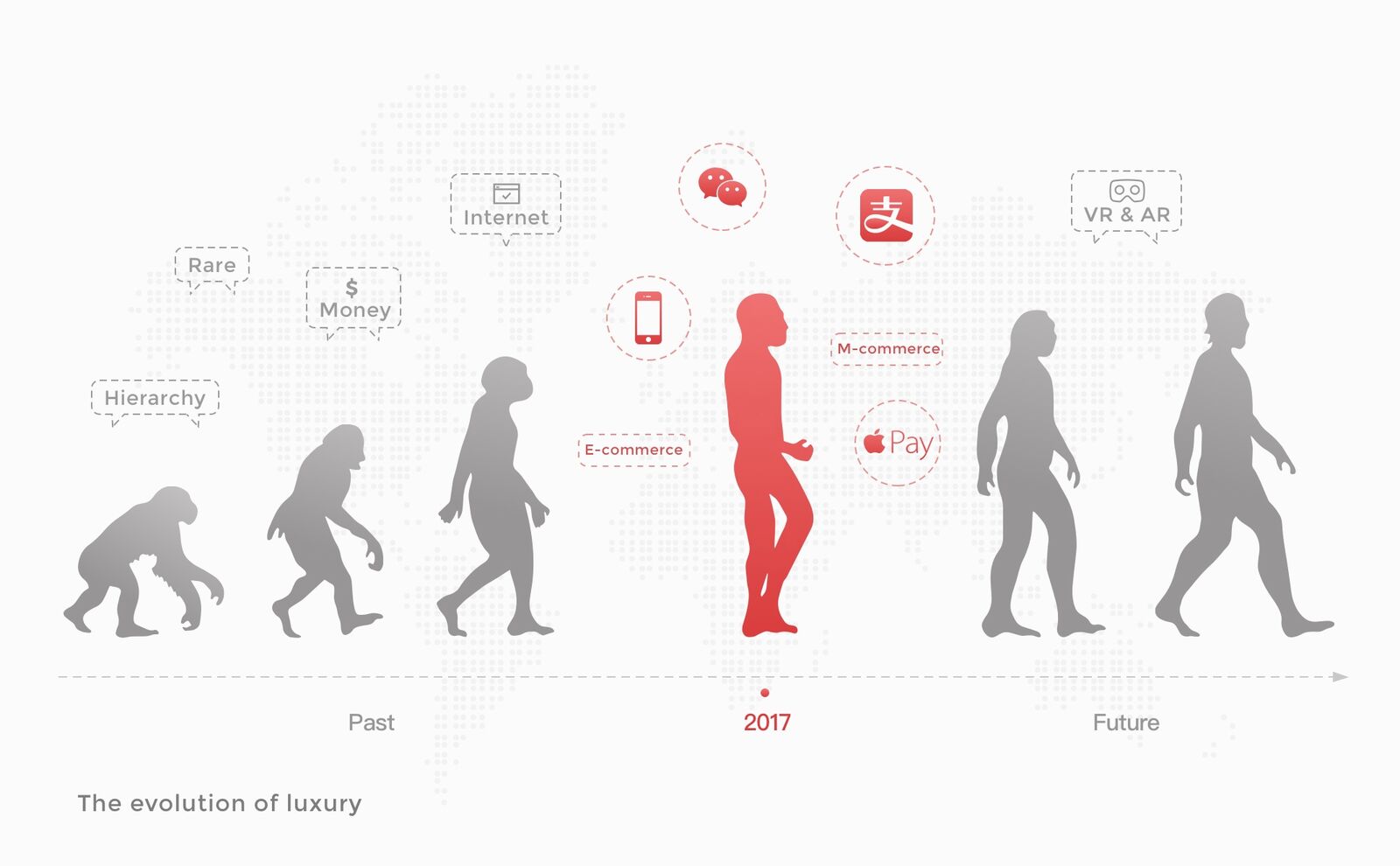

The e-commerce boom - and its shift to mobile - brings in the democratization of luxury, or ‘new luxury’.

Old luxury is expensive, with its prestige based on rareness and exclusivity. New luxury, however, with the democratic reach of various online channels for communication and e-commerce, is much more accessible.

By July 2017, there were 751 million internet users in China including 724 million mobile internet users, which accounted for 96.3% of internet users. (Source: Whitepaper: China Internet Statistics 2017)

As mobile broadband penetration deepens, so does acceptance and usage of local e-commerce platforms, luxury brands can’t ignore digital any longer. In fact, they should consider it the pillar of their overall strategy.

More than a mere additional promotion channel, digital platforms help to track invaluable consumer data while connecting with younger shoppers, their future customer base.

New luxury customers in China : a millennial state of mind

The luxury market is now chasing millennials.

According to Bain, Millennials and Generation Z will account for 45% of the global personal luxury goods market by 2025. “A younger and more sophisticated generation of shoppers with markedly different tastes, aspirations and consumption habits is reshaping the landscape of luxury in China”, said New York times on the matter. A recent survey by Deloitte on millennials’ luxury behavior revealed that young consumers in the China were the number one group “very interested” in luxury spending.

In psychology, luxury is a medium to prove social status or to make a positive impression (Vigneron & Johnson 1999). The millennial obviously take their own codes for ‘new luxury’. They acclaim their value status by brave self-expression and unique self-actualization, rather than how much money they spend on luxury products. Furthermore, thanks to the early exposure to the Internet, this generation know how to acquire luxury-quality goods with pre-research and lower prices.

To succeed in new luxury era, brands need to understand, engage and retain this segment of consumers. To achieve this, they need to know what drives them, what impress them, and how they influence others.

Adapt or die: new strategies for new patterns

“It is not the strongest of the species that survives, nor the most intelligent, but the one most responsive to change.” – Charles Darwin

Facing new market norms and new customer generation, brands must reevaluate their business strategies and act fast.

1. O2O2O (online to offline to online), move to where the customers are

The omni-channel shopping has become an ordinary scenario - comparing price and checking reviews online, buying offline to touch and test the product, reordering and commenting online again. Some big brands are aware of this O2O2O trend, and they act fast to combine online and offline.

Earlier this year, Chinese e-commerce giant Alibaba announced a strategic partnership with Bailian Group, a Chinese retailer that operates over 5,000 stores, another move in its ambition to merge online and offline shopping. On the other side, internet retailer Jet.com has become Walmart’s e-commerce platform since the acquisition last year. They recently launched an aggressive holiday price war campaign to compete with their rival Amazon.

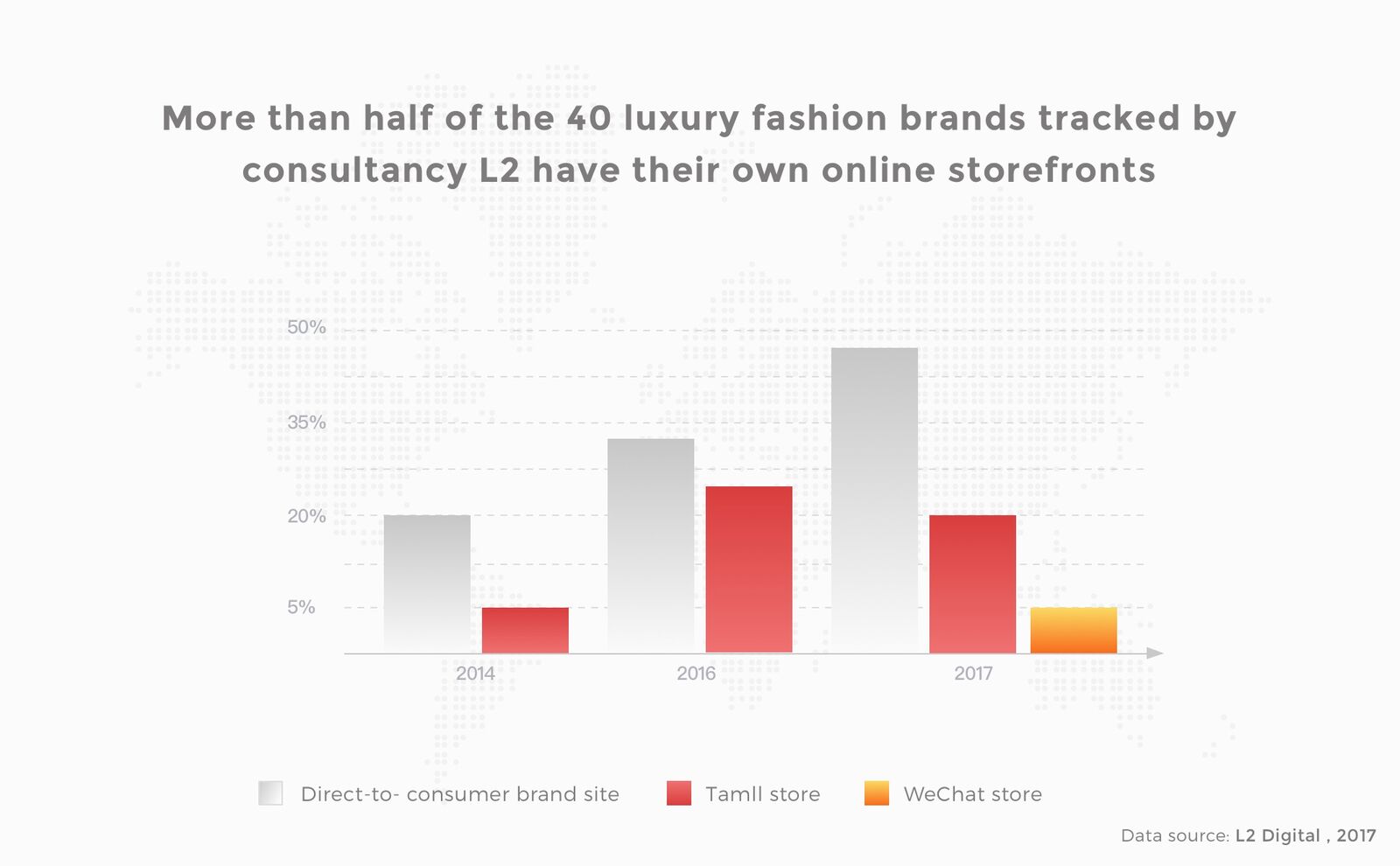

Developing multiple channels of communication to increase touch points with this consumer segment is the key to capturing a leading position in new luxury. According to the “2017 Digital IQ Index: China Luxury” report released by digital media firm L2, among the 89 luxury brands they investigated, less than 10 percent have no e-commerce presence.

Ermenegildo Zegna, an Italian fashion luxury brand, has adopted an O2O2O strategy that allows online customers to check in-store stock and make reservations. Additionally, customers can perform pickups, exchanges and returns, at any of their physical China stores. Zegna also provides a delivery service anywhere across China within 2 to 5 working days, Chinese customers start to take this level of interactivity of online and offline as the benchmark.

See how we helped Etam to design online to offline experience.

2. E-Commerce

With the cashless trend mushrooming in China, especially amongst the young Chinese, the total transaction value in the “Digital Payments” segment amounts to $786bn ( ¥5.18tn)in 2017. To fit in this national practice, Many luxury brands have adapted new e-commerce strategies to provide luxury experience for online customers in China.

In 2017 June, LVMH launched its first multi-brand site 24 Sevres, that put brands like Louis Vuitton alongside those of rivals such as Gucci and Fendi. With its own e-commerce platform, LVMH could get a better control of user shopping experience as well as customer data tracking. The group’s Chief Financial Officer Jean-Jacques Guiony has confirmed that this experiment has played out well so far. Later in July, Louis Vuitton and Gucci launched their mono-brand e-commerce sites in China, following in the steps of Burberry and Michael Kors.

WeChat, China’s most influential social app, has become a testing ground for luxury e-commerce expansion, with Dior, Longchamp, Bulgari, Valentino, Burberry, Chloé, Marni and Lancel successively adopting their WeChat sales campaigns.

On the other side, Alibaba Group has launched the Luxury Pavilion, a new luxury portal within its popular B2C site Tmall. This invitation-only channel aims to highlight the brand exclusivity and create a tailored shopping experience. Luxury Pavilion is available to a select group based on history purchase and Taobao points . JD.com, China’s second-largest e-commerce company after Alibaba, invested $397 million (¥2.62bn) in the leading British luxury e-commerce platform Farfetch, as well as the launch of a high-end delivery service called ”White Glove” .

If your brand is still lagging on e-commerce sales, what are you waiting for?

3. M-Commerce (Mobile Commerce)

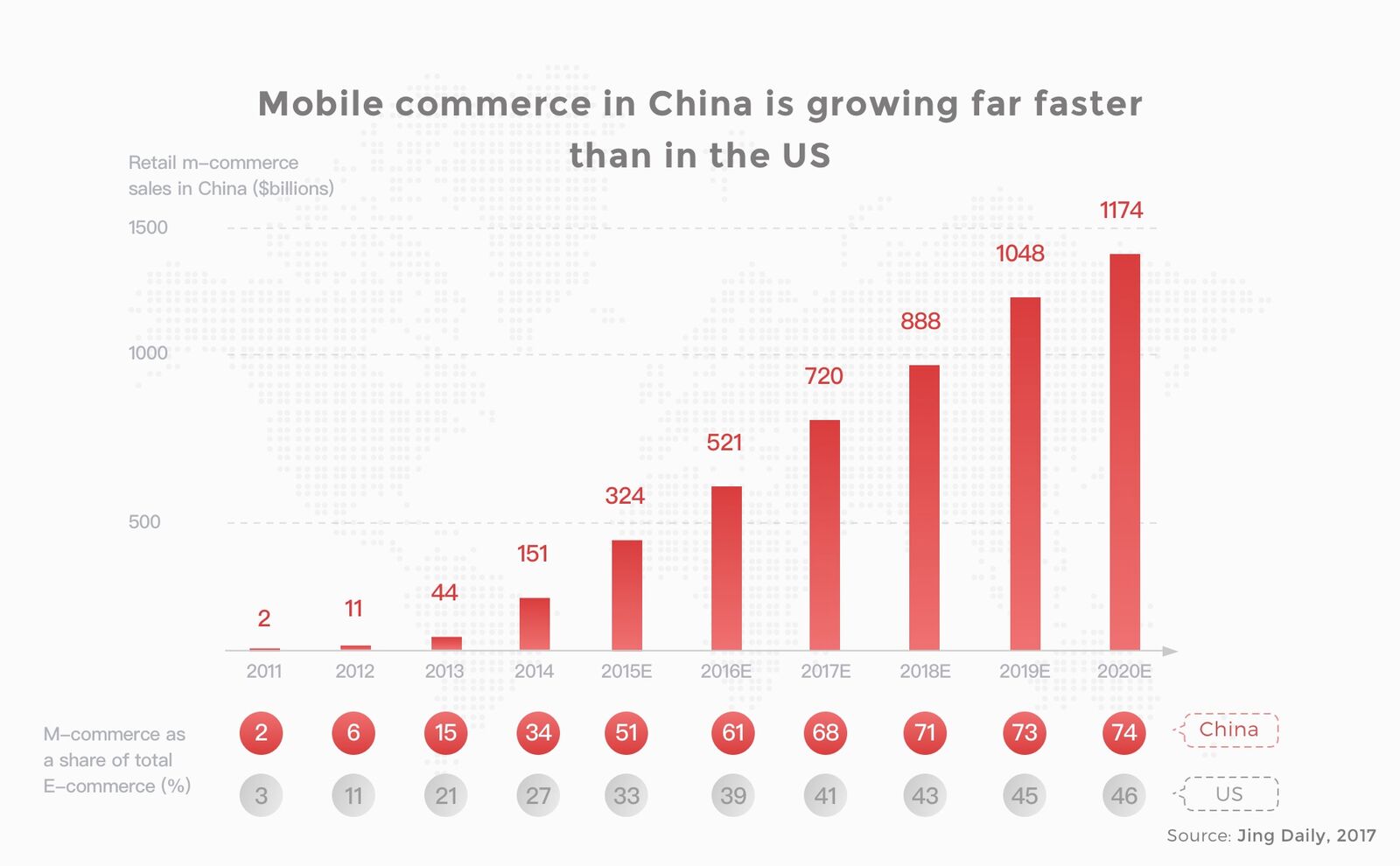

M-commerce has also been a compelling segment of luxury internet retailing.

These affluent luxury customers are tech savvy and digital friendly, and smartphones have become their primary device for content viewing and source for shopping decisions. As a key channel for growing consumers, luxury brands should fully utilize the the width and depth offered by mobile devices as a fundamental part of their branding and commerce strategy.

Most brands have optimized their websites for mobile devices, not only making the site mobile responsive, but also including convenient features like store locator, product suggestions based on past searches, related products and fast check out. On Dior’s mobile tailored website, by pushing a chat button, you can chat with a fashion consultant in real-time.

Direct luxury purchases on WeChat mini programs or mini sites is another way to engage potential costumers. In the WeChat ecosystem, once a purchase is complete, the customer can be seamlessly led to a brand loyalty program, creating a deeper bond.

Check how We launched Sam’s Club’s membership on WeChat within 5 weeks.

4. Real localization for the China market

Every brand is trying to localize, but not many know how to do it correctly. Having a Chinese website doesn’t mean that you’ve finished your localization project.

Here is some advice:

- Engage local social media, WeChat, Weibo, Zhihu, Dianping, Douban.. (read WeChat 101 for dummies)

- Get listed on Brand Zone (品牌专区) or Mini Brand Zone (品牌起跑线) on Baidu, the number one search engine in China.

- Focus on your website’s navigation, don’t overuse flash navigation or image text, it can be dangerous for SEO and usability.

- Rethink your payment methods, people here are spoiled by the cashless lifestyle.

- Involve the customers in your marketing strategy - UGC (user generated content) campaign is a great way to build brand connections.

- Take the website’s loading time into consideration. Dareboost tested the website speed of 49 luxury brands, the average load time of their Chinese sites was 24.1 seconds, four times as long as their global counterparts.

- Get ICP (government) certified, otherwise your pages are at risk of being removed from search results.

- Make your website mobile-optimized.

- Try gamification.

- Level up your loyalty program and integrate it well on your multiple platforms. (I’ll talk about it in my next article)

- Keep up with new technology and new mediums. The Chinese mindset always seeks newness, and Chinese customers like to be surprised.

- Culture related campaigns. With a well-designed WeChat campaign, Chloe sold out all 85 limited-edition bags within the first half-hour of its launch.

- Use VR/AR to enhance the luxury customer experience.

If you need assistance integrating any of these into your strategy, or have interest in having a chat. Drop me an email at [email protected] or simply fill out the form Work with us.